Limelight Investment Services

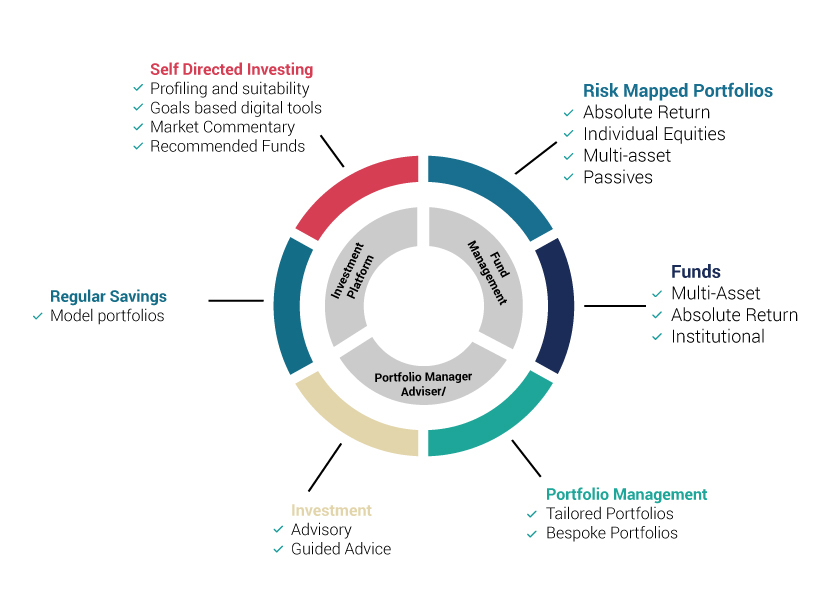

HOWEVER IT’S DONE, YOU WILL WANT YOUR MONEY TO WORK HARD FOR YOU. WE OFFER DIFFERENT SERVICES TO ALLOW YOU THE DEGREE OF INVOVLMENT YOU WISH. HANDS ON, OR HANDS OFF FOR THAT MATTER TOO.

(Not currently available in all jurisdictions)

A BREADTH OF INVESTING SOLUTIONS

TAILORED INVESTMENT SOLUTIONS

HOW WE CAN WORK

Important decisions need expert advice. We’re financial freedom fighters

| DIY INVESTING | INVESTMENT ADVISORY | PROFESSIONALLY MANAGED PORTFOLIOS |

|---|---|---|

PERSONALISED INVESTING:

It's rightly so that investment profiling should target understanding your financial personality - your risk tolerance comfort level for example.

PORTFOLIO MANAGEMENT SOLUTIONS

INVESTING STYLES

PORTFOLIO PREFERENCES

- Multi asset funds

- Traditional fund based portfolios

- Individual equity portfolios

- Passive ETF portfolio

- Absolute return approaches

OUR PORTFOLIO STRATEGIES

However, we think we can go further by matching either a goal or a personality to a style of investing too, and that's why we offer a breadth of investing approaches and portfolio constructions

WHAT’S YOUR ATTITUDE TO RISK

SYMPHONY BESPOKE PORTFOLIO SERVICE

The Symphony portfolio service employs an asset allocation approach that tries to identify where we are in the business cycle,

before determining the appropriate asset mix of traditional assets – stock markets, bonds and property.

It will use a combination of third party funds, managed by best of breed managers and exchange traded funds where appropriate.

Symphony bespoke portfolios are tailored to your specific individual circumstances.

SERVICE NAME:

-

Symphony Bespoke Portfolio Service

SUITABLE FOR:

-

Portfolios from 750,000 GBP plus

-

Risk targeted portfolios, diversified across global equity and bond markets.

-

Strategic asset allocation driven by where we sit in the business cycle

APPROACH:

SYMPHONY PORTFOLIOS

The Symphony portfolio service employs an asset allocation approach that tries to identify where we are in the business cycle, before determining the appropriate asset mix of traditional assets – stock markets, bonds and property. It will use a combination of third party funds, managed by best of breed managers and exchange traded funds where appropriate. Symphony bespoke portfolios are managed to a given risk tolerance and profile.

SERVICE NAME:

-

Symphony Portfolios

-

Portfolios from 50,000 GBP plus

-

Risk targeted portfolios, diversified across

global equity and bond markets.

-

Strategic asset allocation driven by where

we sit in the business cycle.

SUITABLE FOR:

APPROACH:

-

FinaMatrica

-

- Symphony II / 25-40

-

- Symphony III / 41-49

-

- Symphony IV / 50-61

-

- Symphony V / 62-74

-

- Symphony VI / 75-83

-

- Symphony VII / 84-100

RISK PROFILES:

-

DYNAMIC PLANNER

-

- Symphony II / 2

-

- Symphony III / 3

-

- Symphony IV / 4

-

- Symphony V / 5

-

- Symphony VI / 6

-

- Symphony VII / 7

RISK PROFILES:

Parala Macro Multi-Asset

(NOT CURRENTLY AVAILABLE IN ALL JURISDICTIONS)

Parala’s approach to asset allocation uses a proprietary academic approach, developed by asset allocation experts of global standing. The Parala engine uses a sophisticated macro economic model, suing the latest data to predict the best performing asset classes for the near future, creating a ‘heat map’ of investments on a forwards looking basis. Asset allocations are implemented using Exchanged Traded Funds, and are rebalanced monthly using the latest data – it is a hybrid approach benefitting from the advantage of being both actively managed, but passively implemented.

SERVICE NAME:

-

Parala Macro Multi-Asset

-

Portfolios from 1,000 to 200,000 GBP plus

-

A suite of risk targeted multi asset funds, diversified across

nearly 25 across classes, using Exchange Traded Funds.

-

Asset allocation rebalanced monthly, using

the academically developed Parala ‘engine’.

SUITABLE FOR:

APPROACH:

BENCHMARK:

-

IMA Mixed Asset Indices

-

Cautious Income

-

Balanced

-

Dynamic Growth

RISK PROFILES:

All Terrain Portfolio Strategies

(NOT CURRENTLY AVAILABLE IN ALL JURISDICTIONS)

An approach to investing that has a different benchmark – cash – rather than judging performance against a stockmarket. It allows for a wider variety in the asset mix, and will make use of more hedging techniques. Built exclusively using in house managed funds, the portfolios seeks to smooth out some of the volatility associated with traditional portfolios.

SERVICE NAME:

-

All Terrain Portfolio Strategies

-

Portfolios from 20,000 to 1,000,000 GBP plus

-

A suite of risk targeted portfolio strategies, invested using

the ARIA suite of absolute return funds. Each risk profile has a different cash plus performance benchmark and the approach seeks to minimise stock market downside, generally smoothing out returns.

SUITABLE FOR:

APPROACH:

BENCHMARK:

-

Bank deposits + percentage

-

Income

-

Higher Income

-

Cautious

-

Conservative

-

Balanced

-

Progressive

-

Adventurous

RISK PROFILES:

Equilibrium Portfolios

(NOT CURRENTLY AVAILABLE IN ALL JURISDICTIONS)

A purely passive approach to investing. A suite of risk mapped, multi-asset portfolios which bring diversified exposure in a cost effective manner, exclusively using low cost Exchange Traded Funds (ETFs). The models are rebalanced annually, but asset allocations are not actively managed in between times.

SERVICE NAME:

-

Equilibrium Portfolios

-

Portfolios from 25,000 GBP plus

-

A suite of risk targeted portfolio strategies, using strategic asset

allocation across a number of asset classes. Portfolios are not actively managed, but rebalanced annually, performing in line with markets globally.

SUITABLE FOR:

APPROACH:

BENCHMARK:

-

APCIMS

-

Cautious

-

Conservative

-

Balanced

-

Progressive

-

Adventurous

RISK PROFILES:

Value individual equity Portfolios

(NOT CURRENTLY AVAILABLE IN ALL JURISDICTIONS)

Portfolios comprised of individual equities, based on either US, European or UK companies. The approach targets higher yielding shares of blue chip companies, that would appear to be good value compared to their historical valuations or the broader markets. Companies are selected by our professional Fund Managers.

SERVICE NAME:

-

Individual equity Portfolios

-

Portfolios from 250,000 GBP (or CCY equivalent)

-

Three portfolios offering exposure to either the UK, US or European markets.

-

Shares are selected on the basis of having a higher than average

dividend yield and considered ‘undervalued’ according to a range of metrics.

-

Portfolios are managed our professional Fund Managers.

SUITABLE FOR:

APPROACH:

BENCHMARK:

-

FTSE 100, Eurostoxx 50 and S&P 500

-

Progressive

-

Adventurous

RISK PROFILES:

Call Us

You’re always welcome.

Visit Us

Guildford Business Park,

Guildford, GU2 8XG

United Kingdom