Let's start the conversation...

First things first, we’d like to arrange an initial chat

Emotion vs Logic in Investing

Investing is quite simple: buy low and sell high. So why don’t all investors benefit from the simple philosophy that governs the process of the most successful investors globally? I would like to summarise this in one phrase: Emotion vs Logic.

Behavioural finance traits suggest that emotional input gets the better of investors, causing them to make investment decisions that do not follow a logical norm of investing. So, let's break it down from the simplistic view of investment success (buy low, sell high).

All Investors Are Not the Same Investors that buy into the heights of the market can often be doing so by following trends after they are already known to the masses. They may feel that they are missing out on a significant earning opportunity and decide to invest when the proverbial train has already left the station. This is categorised as herd mentality. Whereas investors that sell out of their holdings (at a loss) during periods of decline can be seen doing so to avoid the embarrassment of further losses. This is known as loss aversion.

It would be remiss to say that all investors follow the same path and act in the same way. People can be successful following a herd or selling their holdings during a decline, even at a loss. However, for your everyday retail investors, it can be said that their emotional tendencies can get in the way of making successful investment decisions and with the lack of time, energy, focus and expertise in the field- illogical choices can steer them away from the simple success formula.

Should Investors Follow the Herd?

Following the herd can be a successful route but will often leave many being invested at market highs. A good example of this was the influx of investors into the cryptocurrency Bitcoin (BTC), which experienced its latest meteoric rise within a four-month period – growing from US$ 31,576.20 on July 16, 2021, to US$ 64,400 on November 14, 2021. Several investors invested during this monumental climb out of FOMO (fear of missing out) on the earning opportunity. Many of them are still invested in the asset even now (priced at US$ 19,862 at the time of writing).

Using the Bitcoin example above, people would invest in the asset whilst there is significant momentum and emotionally experience a small amount of pleasure relating to the gain. But when the asset drastically declined, the emotional pain suffered was far greater, leading to an investor making a rash decision and potentially selling the asset at a loss.

Behavioural bias theory suggests that the emotional pain investors experience from losses within their investments is greater than the emotional pleasure they experience from their gains. Therefore, an investor would be likely the investor would have experienced the rise, held on during the fall and subsequently sell at a likely loss.

BTC has acted in a similar manner throughout its history, with large rises and falls. So, the data shows us that holding the asset for a prolonged period would see the price return and even surpass its highest point. So why would an investor sell at loss, are our emotional behaviours impacting our decisions?

The Route to Successful Investing

Removing the emotional element from investment decisions can help investors take more logical actions in their approach to achieving the simple formula of success – buy low and sell high. As history tends to repeat itself, with enough data we can assess whether emotional attributes outweigh a logical path. Although, there isn't – and likely will never be – a definitive answer on which avenue gives more success, because there are always anomalies to every theory.

We can determine that removing rash decisions from one's investments can contribute to greater success. Looking at one of the most well-known indices, the S&P 500, we can see whether behavioural bias can impact our investment returns.

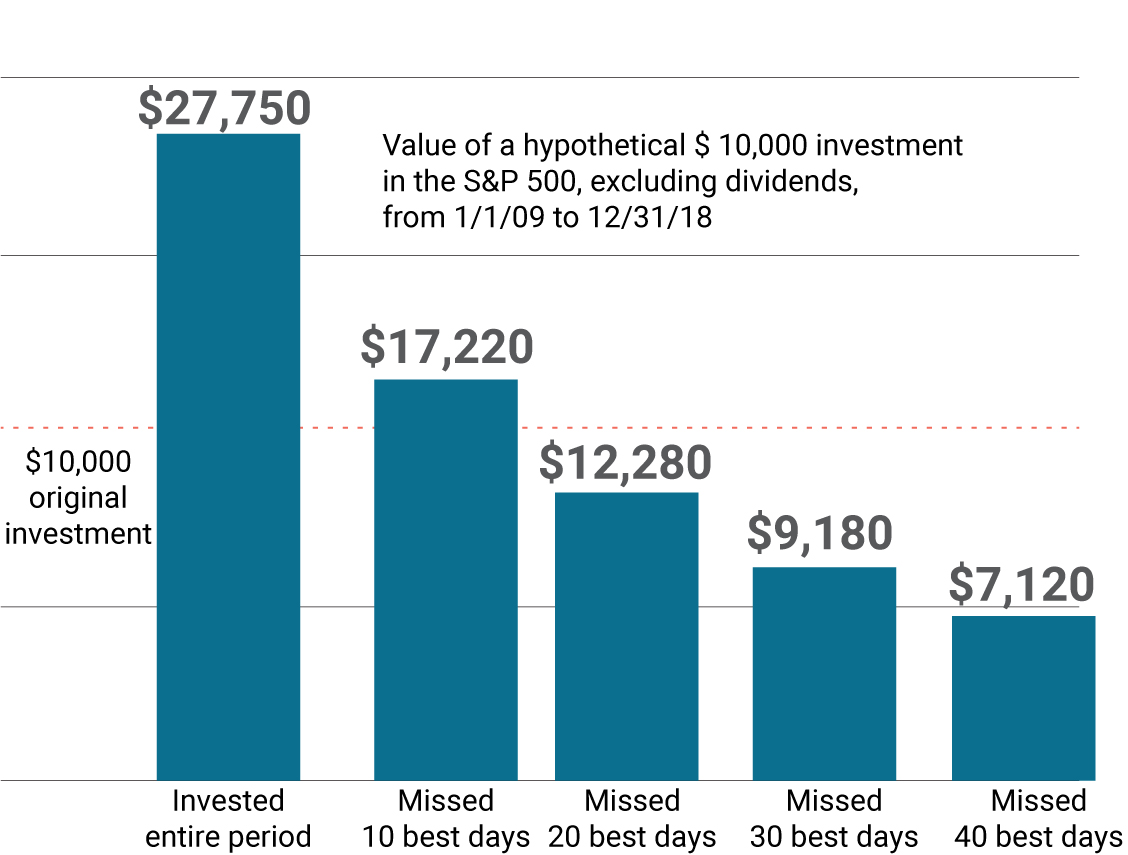

Let's look at the decade after the global recession in 2008/09. The graph shows the hypothetical performance of US$10,000 if it were invested on January 1, 2009, and left invested until December 31, 2018.

Power of staying invested

Source: S&P 500 Index

If the US$10,000 investment was left for the entire period, it would have achieved an average return of 10.75% per annum and valued at approximately US$27,750. On the other hand, following small declines in the market if an investor were to temporarily sit out (disinvest) to avoid further losses and emotional pain: it is also likely to cause the investor to miss out on the best trading days, significantly changing the potential returns. The graph illustrates that missing 40 of the best trading days during the period would leave the investor at a loss, returning $7,120 of the original capital.

Therefore, as we can clearly see, the impact of protecting potential further losses can have devastating effects on prospective gains. Removing the emotional element of investors can have a positive effect. Staying the course and remaining invested throughout periods of uncertainty can be a sure way to follow a successful formula: Buy low and sell high.

More Pain than Pleasure

To summarize, behavioural finance suggests that investors experience more emotional pain from losses within their investments than emotional pleasure from gains, leading to loss aversion. Sticking to a time frame (holding period) for investments can be challenging for investors, especially during market slumps. Emotional input often overrides logical decisions, causing investors to make less profitable investment choices.

Removing themselves from investment decisions can help time and focus-stricken investors take more logical actions in their approach to achieving investment success. Investors who sit out during market declines may prevent further losses, but they are also likely to miss out on the best trading days, significantly impacting potential returns. Therefore, market participants should remain committed to their time horizons and focus simply on buying low and selling high for long-term success.

ARIA IS THE TRADING NAME OF ARIA PRIVATE CLIENTS. OFFICE: BUILDING 2, GROUND FLOOR, GUILDFORD BUSINESS PARK, GUILDFORD, GU2 8XG. ARIA PRIVATE CLIENTS IS AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY. WE PARTICIPATE IN THE FSCS. YOU MAY BE ENTITLED TO COMPENSATION FROM THE FSCS IF WE CANNOT MEET OUR OBLIGATIONS.