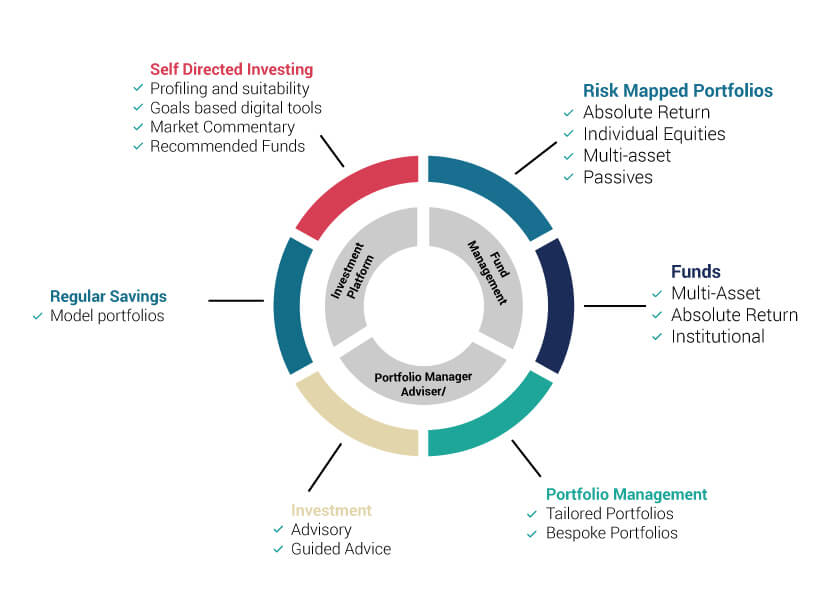

HOWEVER IT’S DONE, YOU WILL WANT YOUR MONEY TO WORK HARD FOR YOU

WE OFFER DIFFERENT SERVICES TO ALLOW YOU THE DEGREE OF INVOVLMENT YOU WISH.

A BREADTH

OF INVESTING SOLUTIONS

Important decisions need expert advice.

We’re financial freedom fighters.

DIY INVESTING

- Over to You, You are in the driving seat. You can deal in investments through an online form and we simply execute your orders.

- Built for those who want to retain complete control of their investments.

- We provide the technology and resources to support a DIY approach.

- Access to a wide range of sectors, number of exchanges and thousands of funds.

- Take advantage from pre-built ‘mini model’ portfolios to benefit from a given theme.

- Invest within a range of tax wrappers including ISAs or simply in a General Investing Account.

INVESTMENT ADVISORY

- Where you take the lead For clients who are comfortable taking the lead, decisions are taken in partnership with an investment manager.

- Designed for those who would like to manage their own money, but appreciate the support of a professional investment adviser.

- A dedicated adviser will be on hand to discuss market developments and your holdings.

- Having made initial recommendations, these are then kept under ongoing review.

- Before investing, your adviser will engage with you to thoroughly understand your circumstances and your aims.

- Benefit from the insights of a longstanding asset management business, with professional fund managers and global reach.

- You remain fully in control of the decision making process at all times.

PROFESSIONALLY MANAGED PORTFOLIOS

- Where we lighten the load From the very bespoke constructions, or our managed portfolio strategies we have a choice of approaches, including different styles and managers.

- A range of risk assessed options including:

- Discretionary: Bespoke Portfolios, and Tailored Traditional multi-asset portfolios (from 200,000 GBP).

- Individual equity/Passive/Absolute Return managed portfolio strategies (from 50,000 GBP).

- Benefit from a rigorous suitability process to design an appropriate investment approach.

- Continuous monitoring means your investments remain matched to your investing objectives.

- A range of styles to suit investing personalities and investing types.

investment profiling should target understanding your financial personality -

your risk tolerance comfort level for example.

PORTFOLIO MANAGEMENT SOLUTIONS

- We think it’s possible to go beyond a risk profiling exercise that ‘takes your temperature’ at a given point in time;

- Investing preferences can change, and suitability assessment can be broader than reducing risk to just a number.

- Whilst assessing suitability is fundamental of any given proposition, we try to offer a range of investing styles and portfolios.

PORTFOLIO MANAGEMENT SOLUTIONS

- A goals based approach means that you may have more than one portfolio for more than one goal.

- A need for income generation is very different for monies that are being set aside for the next generation.

- Therefore, we offer a range of approaches that might refine further mapping a given portfolio to a given goal – a multi asset fund, a passive portfolio of ETFs, or even a share portfolio.

PORTFOLIO MANAGEMENT SOLUTIONS

- Therefore depending on your requirements, we can even combine different approaches, from different fund management companies, including our own.

- The styles we can support include:

- Multi asset funds

- Traditional fund based portfolios

- Individual equity portfolios

- Passive ETF portfolio

- Absolute return approaches

OUR PORTFOLIO STRATEGIES

However, we think we can go further by matching either a goal or a personality to a style of investing too

and that's why we offer a breadth of investing approaches and portfolio constructions

SYMPHONY BESPOKE PORTFOLIO SERVICE CRAFTED AND ACTIVELY MANAGED EQUITY AND BOND PORTFOLIOS

SYMPHONY MANAGED PORTFOLIO SERVICE CRAFTED AND ACTIVELY MANAGED EQUITY AND BOND PORTFOLIOS

PARALA MACRO MULTI-ASSET INTELLIGENT AND DYNAMIC ASSET ALLOCATION APPROACH

ALL TERRAIN PORTFOLIOS AN ABSOLUTE RETURN APPROACH, FOCUSED ON CAPITAL PROTECTION.

EQUILIBRIUM PASSIVE PORTFOLIOS A PASSIVE APPROACH TO INVESTING

INDIVIDUAL EQUITY PORTFOLIOS UK, EU AND US VALUE SHARE INVESTING

WHAT’S YOUR ATTITUDE TO RISK

Answer these short questions to understand more about your capacity and tolerance for taking on investment risk

OUR FREE

RELATED LITERATURE.

CALL US

YOU'RE ALWAYS WELCOME

About Us

Wealth Management

Investing Services

Journal

Call Me

Client Login

ARIA PRIVATE CLIENTS AND ARIA ARE THE TRADING NAMES OF ABSOLUTE RETURN INVESTMENT ADVISERS (ARIA) LIMITED. OFFICE: BUILDING 2, GROUND FLOOR, GUILDFORD BUSINESS PARK, GUILDFORD, GU2 8XG. ABSOLUTE RETURN INVESTMENT ADVISERS (ARIA) LTD IS AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY. WE PARTICIPATE IN THE FSCS. YOU MAY BE ENTITLED TO COMPENSATION FROM THE FSCS IF WE CANNOT MEET OUR OBLIGATIONS.